The pitch is appealing as several young families sit around and wonder how they will pay for college for that remarkably quiet bundle of joy in the middle of their little coffee klatch. Solution? Gerber College Plan! Worth your time and money? Nope. There are better ways.

Besides the reality that most parents with young kids (me included) don’t have time for coffee much less klatches, there’s an odor about this commercial (and it’s not coming from the kid’s diaper).

As a parent with two toddlers and an infant (I’m too old to call myself a ‘young’ parent but a parent of young ones nonetheless), I’m often plunked down in front of the television watching Sprout TV or some such ‘kid-friendly’ advertising-supported programming. Inevitably, there it is. The cute baby face staring back at me after all those happy (and remarkably well-rested) parents have discussed paying for college and decided that the Gerber College Plan is the solution.

Wait, There’s More

Like the Amazing Ginzu, there’s more to the offer here than just money to pay for college. This is Life Insurance, too, that will be there when Johnny grows up. It slices, dices, pays for college and will protect your life, too.

The pitch is undeniable. While retirement can be thirty, forty or more years away for a young working parent (probably 25 in my case), you have – AT MOST – only 18 years until that cute bundle of joy is off for college. So finding a way to pay for that bill – probably as much as the home where that TV klatch is hanging out – is a certain priority.

Compared to other college savings solutions, what’s not to like? The Gerber College Plan is life insurance and offers guaranteed growth with a certain return compared with the potential fluctuations of a 529 Plan tied to stock and bond market investments. Unlike most 529 Plans there are no sales charges. All for one low, affordable fixed monthly payment.

The Reality Show

We live in a world of TV reality shows. If this plan were on one of those shows, it would be voted off the island. The reality is that this insurance plan is a new twist on an old concept. The folks at Gerber are offering an “endowment contract” – a life insurance contract designed to pay a lump sum after a specified term (on its ‘maturity’) or on death. Typical maturities are ten, fifteen or twenty years up to a certain age limit.

But as an endowment contract that violates the Cash Value Accumulation Test, the policy is a Modified Endowment Contract and a policyholder gets hit with a tax bill on gains from the policy.

Fuzzy Math

While insurance is not usually considered an investment and is not taxed, the payments received from this kind of policy will leave you with a headache and a tax bill. And where will the funds come from to pay that bill? Not surprisingly, the insurer provides illustrations that assume you’ll pay with it from other cash. Really?

And whenever someone says that there’s absolutely “no investment or interest rate risk” I have to do a double-take. I’ve never found anything that has absolutely no risk.

Despite assurances to the contrary, these kinds of “insurance” policies can be expensive. Gerber shows illustrations for a $25,000 policy on a 28-year-old dad of a seven-year old child. With an estimated premium cost of about $184 per month, Dad here will accumulate about $24,400 over the eleven years until Johnny goes off to college. When the policy pays out its $25,000 endowment, there will be a taxable gain of about $600.

A better alternative might be getting pure life insurance protection and using the savings over the Gerber College Plan for an alternate savings plan. For instance, if Dad here is in good health he could get a $100,000 face value term insurance policy for around $136 premium per year leaving more than $173 per month that can be contributed to a directly sold (no load) 529 Savings Plan. Here our Dad would have insurance protection and about $28,000 available tax-free from the 529 after the same 11 years (assuming a 4% rate of return).

Maybe that’s enough to pay for one year of college costs (tuition, books, fees and housing) at a four-year public college – TODAY. But it is better than nothing.

Want to see more on these illustrations comparing the math? Then go to the source at the Wall Street Journal’s Money Watch article.

A Better Plan – Cash Value Life Insurance

If you’re going to buy life insurance, then buy life insurance. Most folks are woefully under-insured exposing their families to huge risks. There would be a real issue if a parent were to die during the college years leaving the student and family saddled with student loans or the possibility of transferring to a less expensive school.

And real cash value life insurance has an advantage when it comes to financial aid calculations. Right now, the cash value built up inside a policy is not assessed for any of those pesky financial aid formulas.

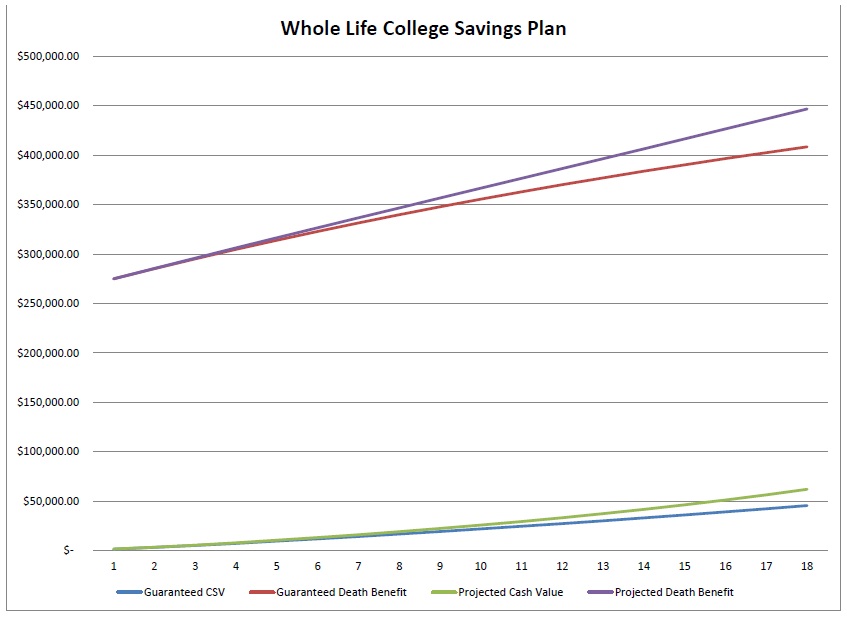

A whole life policy with dividends may very well provide more cash than the Gerber College Plan and 529 Plan examples above – combined – or at least pretty darn close! And you’ll have much needed insurance protection that will last longer and access to cash that you can use for things besides college.

If you want to see a deeper, more detailed discussion on this topic, I’ve found no better source than the folks at the Insurance Pro Blog. Having watched countless repeats of Caillou, Bob the Builder and Angelina Ballerina and seen these Gerber Life commercials, I’ve been wanting to address this for a while and appreciate the commentary I found on this blog about this very issue.

Source: http://theinsuranceproblog.com/gerber-college-plan-review/

There’s a real need to cut through the clutter and confusion when it comes to financial planning, college funding and insurance. Unfortunately, it’s amazing what a company with a large ad buy and social media presence can do! There really are better ways to handle financial planning, college funding and insurance than by using a big megaphone. This is where a true financial planner can help parents better understand their options than any 60-second commercial.