We all know college is expensive and student loan debt continues to grow to nearly $1.2 trillion. But for those nearing retirement, evidence shows that student loans burden older Americans more and more each year. Here at CollegeCashPro, we’ve been telling clients that education funding is as much a retirement problem as it is a paying for college problem.

The rising cost of education has become more than just a burden for millennials. For those who are in their 50s and 60s, we’ve seen student loan balances make up nearly 20% (at least $204 billion) of the total $1.2 trillion of outstanding student loan debt here in the US. Since 2004 balances held by older Americans have increased nearly nine-fold. Student loans burden older Americans – especially those on fixed incomes – disproportionately.

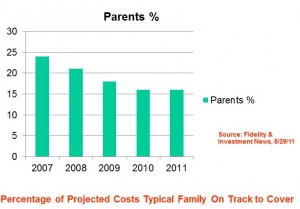

According to a 2011 survey completed by Fidelity Investments, the projected costs of a typical family have continued to increase at better than 4.5% year-over-year for all schools from 2007 through 2011. And the percentage of costs covered by parents from investments, savings or cash flow has been dropping from a high near 25% in 2007 to about 15% in 2011. These trends show no sign of changing in the near future.

As college costs have increased and the amounts saved have decreased with layoffs, recession and stagnant wages for many, the best and only resource available for late-stage clients (parents or grandparents with students in their junior or senior year of high school) tends to be loans.

While recent grads are seeing student loan balances rise to an average of $30,000, we’re seeing loan balances for parents and grandparents rise to an average $20,000. These averages don’t tell the whole story. The total cost for an education may be underrepresented in these loan numbers. Why? Most families also pay out of cash flow and savings. Others tap home equity which is not counted in these averages.

Some of these loan balances may be a result of debts incurred by those in their 50s or 60s who went back to school later in their working lives to change careers after other opportunities dried up in main line manufacturing industries or to finish a degree started long ago or to obtain a graduate degree. Some of this may also be a result from direct or indirect student loan debt because of their generosity to other family members.

In any event, when you add up the direct private or federal loans taken by these seniors as well as add in the loans which they may have co-signed for their kids or grandkids, you’ll understand how big a potential problem this is for retiree cash flows.

If you or your grandparent is heading into retirement with student loans, it’s time to think about next steps to avoid a cash flow crunch.

Don’t Default on Your Student Loans

Student loans cannot be discharged through bankruptcy. Some seniors may believe otherwise. But not paying your loans is not a good option. The federal government will find you and can garnish your wages, withhold your tax refund or take some of your Social Security benefits. I’ve seen too many folks who regularly count on their annual tax refunds to fund their plans or a special purpose.

Recently, I spoke with Ferdinand (not his real name) who called because he hadn’t received his $1,400 refund from the IRS though it had been nearly three months since filing. His plans to pay his medical bills fell through when I told him that the refund had been applied to an old outstanding tax bill.

Now imagine what happens when that same thing happens to a senior on a fixed income.

And if you’re in default on your student loans, you’ll lose out on other repayment options that may actually improve your cash flow.

Income-Driven Repayment Plans

One great option to consider are the various income-driven repayment options for federal student loans. The standard repayment term for student loans is ten years. But that comes with hefty payments which make it difficult – to say the least – to pay for other living expenses.

If you qualify, you’ll make payments based on 10% or 20% of your discretionary income instead of the standard payment. And as long as payments are made on time for twenty or 25 years, your remaining balances may be forgiven. There are three basic income-driven repayment plans: Pay As You Earn, income-based and income-contingent. More information is available on the US Department of Education’s website. These options only work with federal student loans.

Consolidation or Refinancing Options

Think of this option like refinancing your mortgage to a longer term. Your monthly payment will be lower but your total interest paid out will be higher. So there’s a trade-off between improving your cash flow and your total loan cost. Sometimes this is the best way to handle your debt though.

For parents who have federal PLUS loans (Parent Loan for Undergraduate Studies), you may have some relief in the form of a loan consolidation first and then applying for one of the income-contingent plans.

Bad news for private student loans though. Such an option is not available. Your best bet is to try to negotiate with the lender for a lower rate or move to refinance with a different lender.

Another option to consider is to refinance your home or use a home equity line of credit (HELOC). Yes, the mortgage isn’t forgiven when you die but you have the option to stretch out payments at a lower interest rate than most student loan refinancing rates. And you may be able to get a tax deduction on the mortgage interest (talk to your tax preparation professional) which you don’t get on student loan interest.

Another related option to consider is a reverse mortgage. For those who are homeowners and are over age 62, you can use the equity in your home to pay off outstanding mortgages, liens and loans – including student loans. Here’s a link to a post I did on this topic a while back. While there have been changes to lower costs in the programs since this post, you can get a good idea.

You may also benefit from a review of your household cash flows to find money that may be leaking out of your wallet. This found money may help close the gap. Consider subscriptions to online services, magazines or cable that you don’t use. Maybe you can replace some of these with free services like borrowing from your public library. Maybe you can change your deductibles on your home and auto insurance to lower your costs. Maybe you can request a property tax abatement based on your age or income.

Bottom Line: Your choices about college funding can impact your retirement. If you’re approaching retirement, you need a qualified financial planner who can help you sort out your cash flow and options. And for those whose kids or grandkids are approaching college, you really need to talk with someone to help get rid of student loan debt before they enter school as well as before you retire.